Investment Examples

Location: High-growth secondary market in the Southeast U.S.

Strategy: Renovate interiors, increase rent, improve management

Project Summary:

60-unit apartment complex. Rents are under market, and 50% of the units need light upgrades (flooring, paint, hardware). Improve management practices, reduce tenant turnover, and increase rents by an average of $125/unit.

Investment Highlights:

Amount: $100,000

Hold Period: 5 Years

Preferred Return: 8.5% (paid quarterly)

Average Annual Return: 18%

Equity Multiple: 2.1x

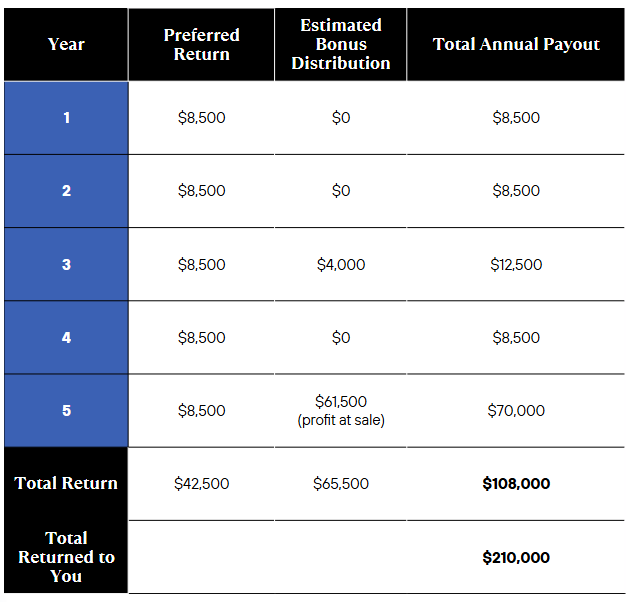

Location: Tertiary market with strong rental demand and limited new supply

Strategy: Convert a former LIHTC property into market-rate affordable housing with upgrades

Deal Summary:

72-unit affordable housing property. After the expiration of long-term affordability restrictions, upgrade 60% of the units (including new flooring, cabinets, and appliances) and improve landscaping and exterior appearance. Over 2 years, phase in $200/month rent increases while preserving affordability for qualified tenants through voucher programs. Cash flow began in Year 3.

Investment Highlights:

Amount: $100,000

Hold Period: 5 Years

Preferred Return: 6%

Average Annual Return: 20%

Equity Multiple: 2.1x

Location: Southeast U.S. primary/secondary markets

Strategy: Major renovations, rent repositioning, and property rebranding

Deal Summary:

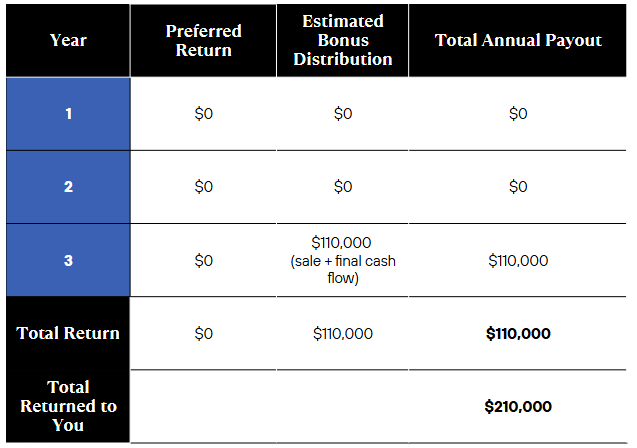

40-unit apartment complex in distressed condition at acquisition. Complete full renovations in all units, including new kitchens, bathrooms, HVAC, flooring, and fixtures. Rent increase by an average of $300/unit, and rebrand with new signage and landscaping. Hold for 3 years and sell at a substantial gain after stabilization.

Investment Details:

Amount: $100,000

Hold Period: 3 Years

Preferred Return: None

Average Annual Return: 27%

Equity Multiple: 2.1x

Why This Matters for You

You don’t have to manage tenants, contractors, or property operations. As a passive investor, you benefit from:

Option for quarterly cash flow distributions

Equity growth through value creation

Preferred referred returns paid before the sponsor profits

Potential to double your capital over the life of the project